irrevocable trust capital gains tax rate 2020

2022 Long-Term Capital Gains Trust Tax Rates. The tax rate schedule for estates and trusts in 2020 is as follows.

Presidential Debate Highlights Differences In Tax Policy Insight Law

The trustee of an irrevocable trust.

/GettyImages-1009092686-e86fae5ce1184f3491f27c2e33cde8c0.jpg)

. The maximum tax rate for long-term capital gains and qualified dividends is 20. The maximum tax rate for long-term capital gains and qualified dividends is 20. Select Popular Legal Forms Packages of Any Category.

For tax year 2020 the 20 rate applies to amounts above. Learn More About PIMCOs Thinking on Inflation and its Significance for Investing. 3 What is the tax rate on an irrevocable trust.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Contact Coral Gables Trust Attorneys. For tax year 2020 the 20 rate applies to amounts above 13150. Free shipping on qualified orders.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual. Sunday June 12 2022.

Income and short-term capital gain generated by an irrevocable trust gets. Capital Gains and an Irrevocable Trust- Having this trust affects who pays any owed capital gains taxes. Qualified dividends are taxed as capital gain rather than as ordinary income.

In 2020 to 2021 a trust has capital gains of 12000 and. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. For example the top federal.

1 What Is The Capital Gains Tax Rate For Irrevocable Trusts. 216 Other trusts 36. You need to weigh pros and cons.

Report the applicable amounts calculated on this form on line 13200 or line 15300 of Schedule 3 Capital. What is the capital gains tax rate for trusts in 2020. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The trustee of an irrevocable trust has discretion to distribute income including capital gains. Irrevocable trusts are very different from revocable trusts in the way they are taxed. 2 Do irrevocable trusts pay capital gains taxes.

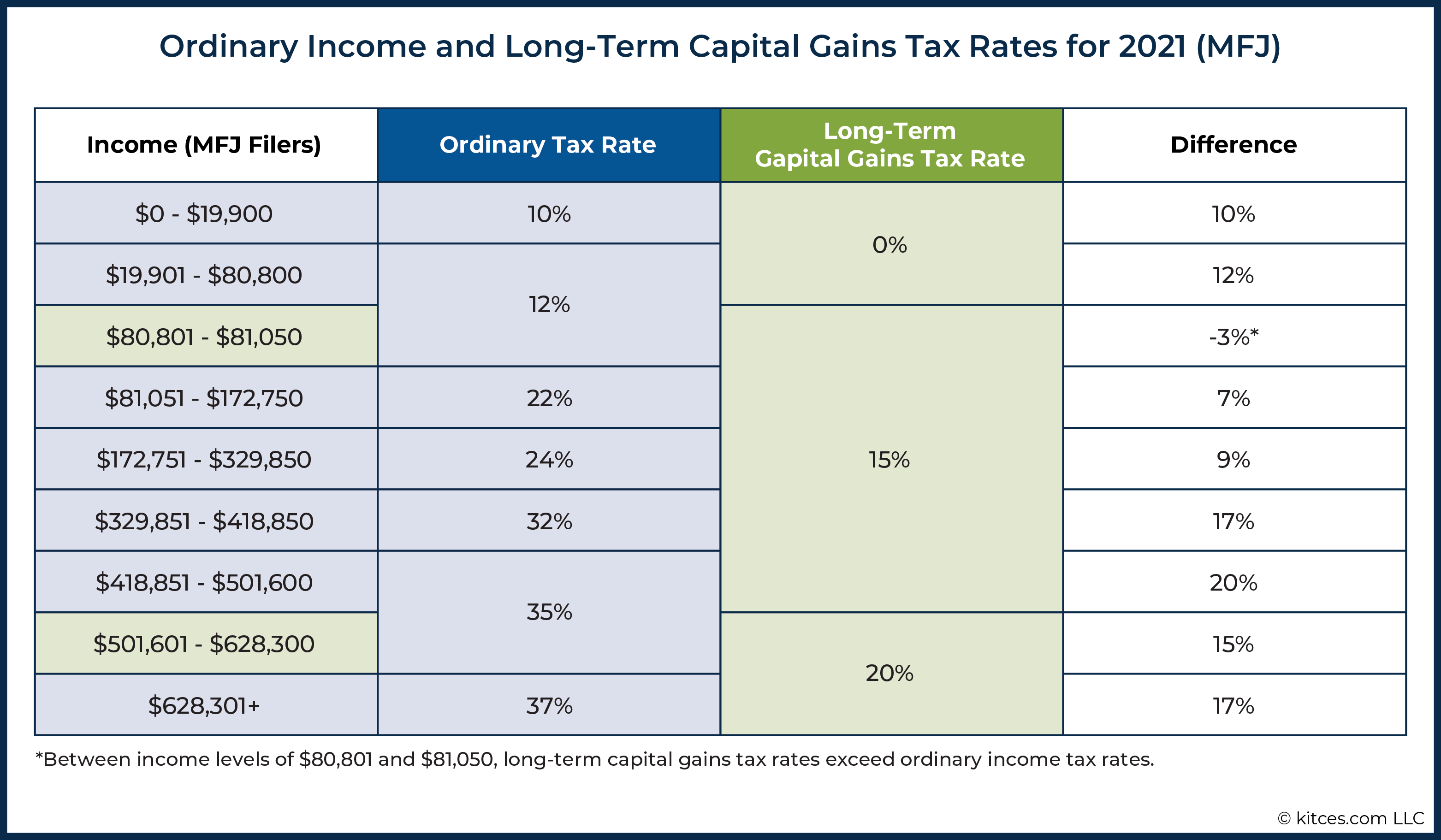

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22.

For tax year 2020 the 20 rate. All Major Categories Covered. Free easy returns on millions of items.

4 What is the tax rate. If you have additional questions or concerns about capital gains. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Consequently if the trust. What is the capital gains tax rate for trusts in 2020.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Ad Explore PIMCOs Solutions to Help Investors Navigate Inflationary Risks. Financial privacy flexibility and asset protection.

For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a. It continues to be important. The 2020 estimated tax.

For more information please join us for an upcoming FREE webinar. Instead capital gains are viewed as contributions to the principal. Capital gains however are not considered to be income to irrevocable trusts.

For tax year 2020 the 20 rate applies to amounts above. Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Irrevocable trust capital gains tax rate 2020. By comparison a single investor pays 0 on capital gains if their taxable income is. Ad Take the first step in financial privacy and keep your assets out of harms way.

Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank.

Your Guide To Prorated Taxes In A Real Estate Transaction

How Tax Changes May Impact Small Businesses Putnam Wealth Management

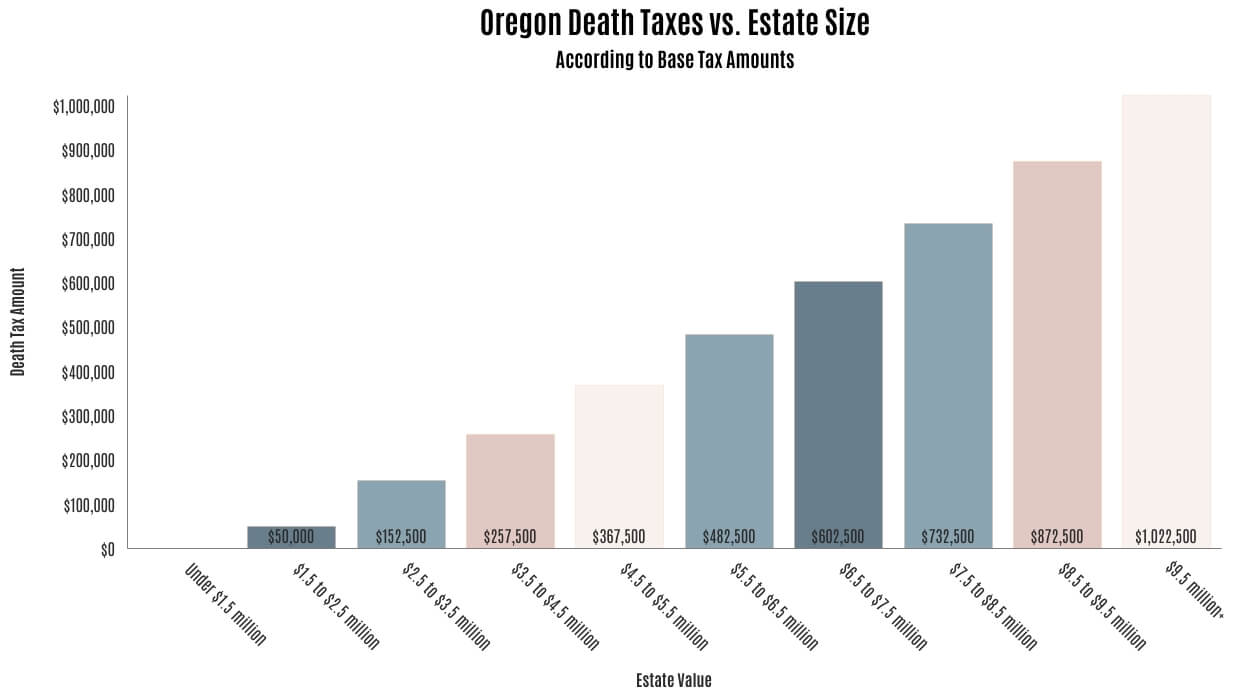

Oregon Death Taxes Death Taxes In Central Oregon De Alicante Law Group

Tax Strategies Using Nua For Modestly Appreciated Stock

Tax Strategies Using Nua For Modestly Appreciated Stock

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Eight Things You Need To Know About The Death Tax Before You Die

Should You Sell Your Investment Property Before Retirement

Living In Different States Could Help Married Couples Reduce Their Taxes

Two New Income Tax Surcharges Included In Build Back Better Act Wealth Management

What Is The The Net Investment Income Tax Niit Forbes Advisor

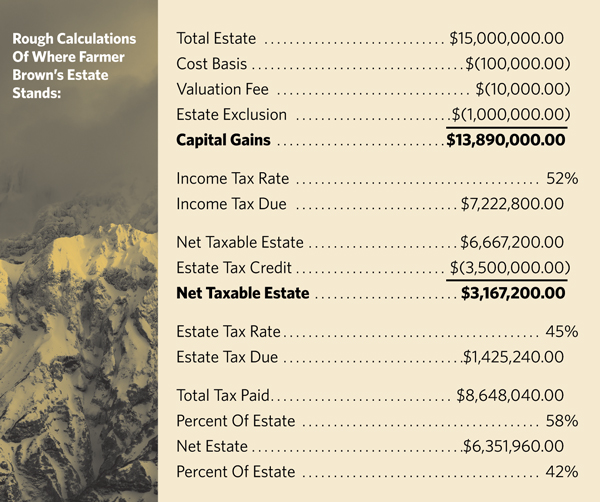

Draconian Tax Could Put A Big Hurt On Estate Planning

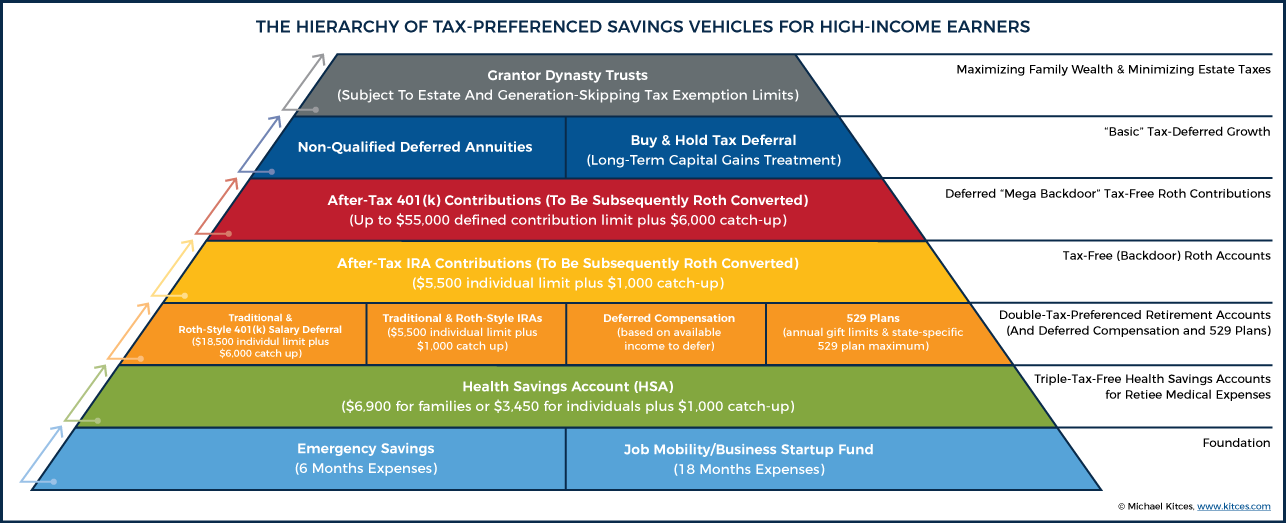

The Hierarchy Of Tax Preferenced Savings Vehicles

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

High Net Worth Families Should Review Their Estate Plans Pre Election

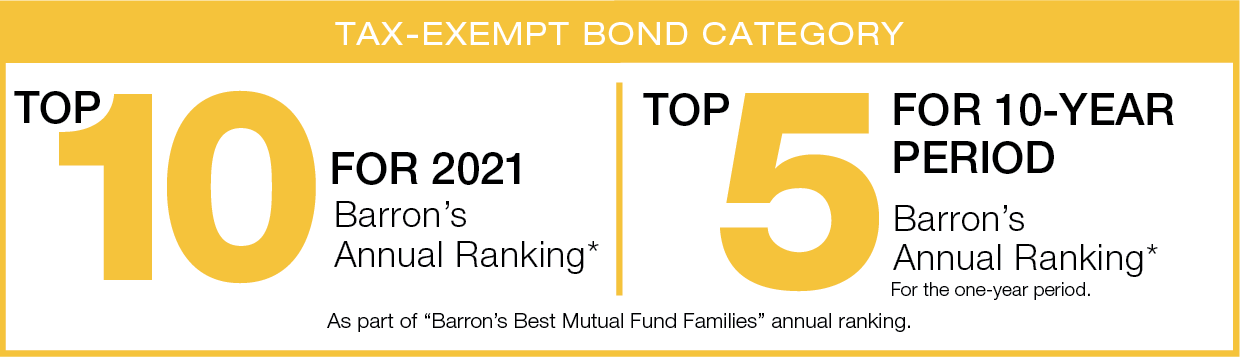

Lansx National Tax Free Fund Class A Lord Abbett

How Tax Changes May Impact Small Businesses Putnam Wealth Management